Utilize Section 179 Now

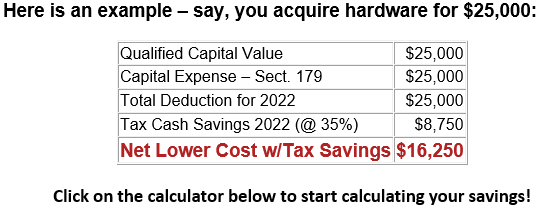

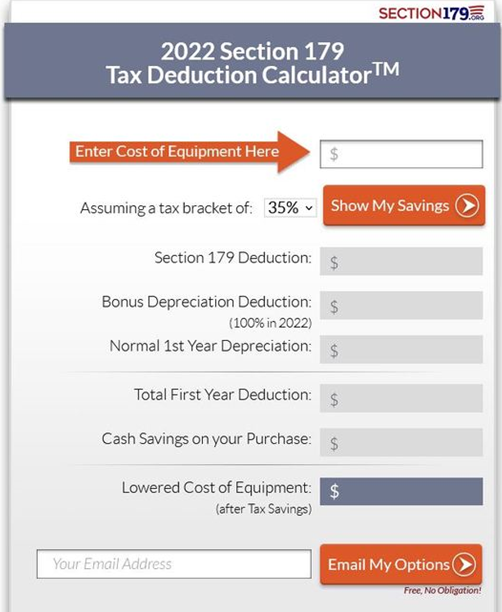

NOTE: Businesses can take advantage of 100% bonus depreciation on both new and used equipment for the entirety of 2022.To be eligible for a 2022 Section 179 deduction, the equipment must be purchased and put into service by midnight 12/31/2022.

Leasing and Section 179

Did you know that your company can lease equipment** and still take full advantage of the Section 179 deduction?

In fact, leasing equipment and/or software with the Section 179 deduction in mind is a preferred financial strategy for many businesses, as it can significantly help with not only cash flow, but with profits as well. You can deduct the full amount of the equipment, without paying the full amount this year. The amount you save in taxes can actually exceed the payments, making this a very bottom-line friendly deduction.

*2022 deduction limit is $1,080,000 and 2022 limit on equipment purchase is 2,700,000. Software subscriptions do not qualify, but purchases of software such as Printerpoint and PaperCut do qualify.

**Not all these types qualify of Section 179.

866-665-7604

866-665-7604